GOLD: BEWARE OF IRRATIONAL EXUBERANCE.

REMAINING RATIONAL IN THE WORLD OF FINANCIAL ASSETS.

THERE IS NO ‘HOLY COW’ IN FINANCIAL ASSETS MARKETS.

There are several reasons why gold prices should and should not keep on going up.

The ever weakening dollar- the gold bulls argue that the dollar is going to continue to weaken and due to that gold prices will continue to rise. But friends we have seen in history that the dollar has slid against euro even lower levels than the recent lows.

Negative point:

The bear market in gold lasts a lot greater than that of equity.

I also feel that the end user has certain non-tolerance level when it comes to use of gold prices. The industrial people will definitely cut back on inventories while the users of jewelery will unless inevitable, not buy jewelery

There is a limit of tolerance for end users-the industry.

When more return/crazy euphoric bull markets in emerging-other equities will start fund managers will move from gold to equities.

People need to understand that International Funds/investors including hedge funds are traders of financial assets. They don’t fall in love with them. They trade with stoplosses and extensively use technical analysis and quant theories and models. So infact they are the biggest risk to gold prices because when they will sell, they will not care about ‘the the holy precious metal’ status. They will just sell when their trailing SL is hit.

IS WAR COMING?:

In fact the 9-11, afganistan, Iraq war ended. In case china invades Iraq it will not affect usa or Europe because their natural resource needs are satisfied by africal and other countries. Can china go war with usa. No one has given such opinion or view. China owns billions of dollar to America and japan is the world’s largest creditor nation. USA is increasingly strengthening its association with china. The terrosiam is an almost taken for granted permanent phenonmena. It impacts only crude oil and other commodities of ‘supplyable value’, mostly crude and natural gas. Both’s prices rise if some of these gang attacks on pipelines anywhere.

Gold is hoarded and is mostly recyclable unlike crude oil and agricommodities which are perishable and once used can not be recovered or reused.

The strongest point for gold is UNCERTAINTY IN CURRENCY MARKETS. A safety against currency crisis. Otherwise the reason for its priceros due to its emergence as an asset class seems to over-spoken. Its new for us but a decade old for the western ‘split second, pip’ investor and traders. If the currency crisis is coming it should have come when the lehman collapsed and almost the whole western economies paralyzed which was even termed immediately ‘to be a 1930 type of great depression’. If china don’t like dollar or want to sell dollar short of knows that it is going to diminish in value than why it is taking it's bond? Why it is giving loan to it. Today china is the biggest creditor of USA.

We don’t argue that the USA is omnipowerful or that the dollar will rule the world for next 100 years and more. But if the currency has to fail,these are surely not the signs of failing. In fact the depreciation in dollar helped USA to import cheap while its factories were down for a year and half due to recession. And assuming that the dollar will rise then the USA will pay less in interest for loans taken.

USA DEFICIT IS ALSO NOT NEW

USA has seen skyrocketing/gigantic deficits in its history. This is not new. People like jim rogers, buffet, mark faber have repeatedly criticizes USA govt. and fed to /borrow excessively/become debtful and print money and flood the system with money. But it should be noted that this is what is monetary economics all about. Its not that this is right. There are other proper ways. But nothing is perfect. Infact people praised fed and USA govt to save the economy from the SEVEREST ECONOMIC CRISIS SINCE 1930 DEPRESSION (we suspect if people will say it so, because the financial markets in the usa and other countries have already recovered, and as we are writing the usa dow jones is not much far from highs. Indeed this seemed to be a depression of financial markets and similarly a recovery of financial markets. After all it is a ‘financial market economy’. If it were a ‘real market economy’ such as in 1930 then the so-called 2007-08’s 1930 like of depression would have lasted much longer because that depression lasted more than 3 years until the government acted.

HISTORIC GOLD PRICE-CHARTS:

1975 2000.

1980-2007.

Started rising in 2002 till date.

GOLD UPS AND DOWN IN CHARTS:

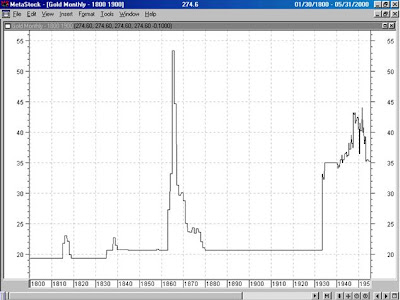

The following chart corresponds to 1800 to 1900 year.

Chart 2-1800-1950

1900-2000.

Chart 4

1920-2000.

Chart-5-

1970-2005

1973-1979.

Chart-7-

1983-1988.

Chart-8-

1989-1994.

Chart-9-

1999-2005.

GOLD JANUARY 1975-NOV2009:

It can be seen that the gold prices which were around $200 in 1977 went up to $750 in around three years and came down to $300 level in next four year from where It hovered between $250 to $400 until it gave upside breakout in the year 2002 since when the prices are going strong till date except a $250 correction before a year. So it can be said that the recent bull market is 7 year old which the longest bull market is in the lifetime of gold.

Below is Gold-London PM Fix 1975- present.

TAKE AWAYS FROM THE HISTORIC CHARTS:

The gold follows a big cycle, at least till date; and the bad news is that the bull market lasts only one fourth of the time of how long the bear markets lasts. In other words the bear market in gold lasts for four times longer duration than the bull market lasts. The positive point for gold for this dream run of a decade long rise in prices has been mainly driven by the gold inventories occupied with custodians as hoards/investments by gold ETF funds world over.

Chart corresponding to year 2000 and 2010 gold price movements.

London PM Fix 2000-present

BELOW IS THE IDENTIFIABLE GOLD DEMAND. FIGURES FROM YEAR 2000 TO YEAR 2009.:

Historical data for identifiable gold demand:

Year | Tonnes measurement | In USDbn, value | ||||||||

jewellery | Net retail investments | ETF and similar | Industrial, Dental, etc. | Total | jewellery | Net retail investments | ETF and similar | Industrial, Dental, etc. | Total | |

2000 | 3204 | 166 | - | 451 | 3822 | 28.75 | 1.49 | - | 4.05 | 34.29 |

2001 | 3008 | 357 | - | 363 | 3728 | 26.22 | 3.11 | - | 3.16 | 32.49 |

2002 | 2660 | 340 | 3 | 358 | 3362 | 26.49 | 3.39 | 0.03 | 3.56 | 33.47 |

2003 | 2483 | 301 | 39 | 382 | 3206 | 29 | 3.52 | 0.46 | 4.46 | 37.45 |

2004 | 2617 | 349 | 133 | 414 | 3512 | 34.43 | 4.59 | 1.75 | 5.44 | 46.20 |

2005 | 2712 | 393 | 208 | 432 | 3745 | 38.73 | 5.56 | 2.97 | 6.17 | 53.51 |

2006 | 2288 | 416 | 260 | 460 | 3424 | 44.42 | 8.07 | 5.05 | 8.92 | 66.46 |

2007 | 2405 | 433 | 253 | 462 | 3552 | 53.76 | 9.67 | 5.66 | 10.32 | 79.42 |

2008 | 2187 | 863 | 321 | 436 | 3806 | 61.30 | 24.18 | 9 | 12.21 | 106.69 |

2009 | 1747 | 676 | 595 | 388 | 3386 | 54.62 | 21.14 | 18.59 | 11.49 | 105.85 |

*figures for the yr 2009 are provisional.

*sources-wgc, gfms and others.

Above we see the identifiable demand for gold in tones measurement as well as in value (USD), from the year 2000 to year 2009 (please note that 2009 data are provisional).

Key takeaways of the above chart/figure:

The average industrial and dental use has been steady at average of 412 tonnes per year and does not seem to be significantly rising from this point as to spur shortage of supply and contribute in price rise.

Similarly the jewellery side of the demand has also been on the decline and there cannot be any argument that due to increase in the jewellery demand world over the prices have tended to rise. The demand in the year 2000 was 3204 tones and then after the demand in tones measurement has never risen till date which is also closely the case with industrial and dental demand.

Another identifiable demand area ‘net retail investment’ has been rising continuously from the year 2000 to 2009 from 166 tones to 676 in year 2009. And mark this is in tones and not in value! Which is a remarkable rise. Now translating into value (USD) terms it comes to staggering 14-15 times rise, while in tone measurement terms the rise is some 3-4 times only which is not as remarkable looking at the increasing awareness regarding gold as an investment avenue, gold ETFs, , the earlier dotcom bubble, the 2008 sub-prime led crisis and so on so called positive points for gold prices. The prices of gold have doubled in during 2005, 2006, 2007 and 2008. In 2008 it touched 800 dollar mark. Otherwise the prices were hovering around dollar 400 during half of 2003 and whole of 2004. Before it breached dollar 500 mark in Jan 2006, it ranged between 400 and 500 USD per Oz.

Now the most important point comes here. The financial innovation washed out several when it came to subprime, cds and so on in case of the subprime debacle, but the evolution of ETFs helped gold immensely. Starting from 2002, the gold investment hoard in tones has risen to close to 600 tones in 2009, while also taking the gold prices with it together up and up.

Below is the chart for identifiable demand in tones and USD value,

“The annual supply of gold from various sources namely, mines, govt/inst., and recycled gold has remained steady at an average of 4000 tones.” See below figure, chart-7.Annual gold supply, tonnes. While we expect that the official sector sale would rise when the figures for year 2009 and year 2010 release.

GOLD AND CHINA:

As you can see below the demand in China has been almost stable during 2000-2006 period. It is only 2007, 2008 and 2009 that the jewellery segment demand of gold has been rising. While similarly the net retail investment pictured in brown colour has also been rising during the same period. We have already seen that the net retail investment has risen spectacularly due to rise in gold ETF funds world over.

OUT OF FAVUR FOR GOLD: or THE RISK SIDE:

China recently told it is not interested in mopping up anymore gold from markets.

Even if the gold prices are not going to go down and remain steady or rise 5% a year as expected by commodity bull Jim Rogers why invest in gold when far better superior return are going to be earned from equity markets.

I think gold ETF is alos just like any other asset and I don’t feel the need to give it extra advantage as an investment class asset. In fact the world can do without gold any time but can the economies grow without copper, aluminum, or can we survive without food grains? So what we argue is to remain rational in this world of financial assets.

Yes for diversifying one can look at gold. Buy why gold only? There are commodities funds available in which all the commodities are covered and not just precious metals like gold, silver but also base metals, energy, agriculture, even livestock are included in many international funds.

Note: This writing will be updated with more contents and commentary. Please visit for update here.

Sources: gmfs, wgc, etc.

© Megha Investments and Research,

0 comments:

Post a Comment