FUNDAMENTAL STOCK PICK:

SUZLON ENERGY

CMP 90

TARGET 150

Suzlon is world’s 3rd largest wind power co.

Company sells its products in 21 country including worlds two fastest growing country India and china.

As per global wind energy council by 2013 there will be 332 giga watt (1giga watt=1000 mega watt) of wind power from current 120 giga watt, means there is addition of 212000 mega watt!

International support to renewable energy from USA, China and India are also favourable for this company.

In India there is a big gap between demand and supply of energy which will push the door of renewable energy such as wind energy because of its low cost and fast commencing of power project and eco-friendly in nature.

Buy out of Hansen and RE-power will boost the top line and bottom line of the company and will also help to diversify revenue across the globe.

To tap the opportunity of 212000 mega watt co has capex plan as under which will be operational within 2 years.

The company is making 15 bn for integrated wind turbine manufacturing facility.

The company is making Rs 11 bn for forging, foundry and machining facility.

MUTUAL FUND PICK:

KOTAK COUNTRA

Recommendation: Avoid for investment.

Reason: This fund fails to delivery impressive return compare to its bench-mark index.

WEEKLY MARKET OUTLOOK:

Support 5170/5110/5060

Resistance 5308/5361/5425

Nothing more to say about the market as we have already given our “BOLD AND TRANSPERANT” view by giving graphical presentation In the last week’s report.

More confidence will come after this week as 16 major index companies will deliver their results.

Apart from sensex and nifty one index looks more promising then any other which is oil and gas index.

Oil and gas index is about to begun the 5th and last wave of Elliott wave!

Major index has been rise close to 4 to 5 time from the bottom of 2008

But this oil and gas index has rise 2.50% and underperformer the rally of 2009.

We have attached the chart with analysis.

In Elliott wave last leg of rally is for those who left the party at lower levels and for the professional traders who always loves 1st and 5th wave of Elliott wave because both are explosive and fast return generator in nature.

What to expect from base oil and gas index from current 10800 levels?

As per Elliott wave target could be around 18000+ levels.

As per rule the targets of 5th wave is the distance of wave 1 multiply by golden ratio 1.618 and add to the end of wave 1.

In BSE oil and gas index the target can be 18000+

If the last leg of wave starts in the BSE oil and gas index then it will be the theme of 2010 investments and will out performer the broader market,

And we can expect this will help (reliance ind

To support my analysis ‘ see some news which will be flash in 2010/2011 about the oil and gas companies.

Cairn India

This company will start its full capacity by 2011 which is 130000 barrel per day of production.

Reliance ind

This company’s shares sold by treasury which bought by intuitional like LIC and FIIs which is supporting to take over bankrupt Lyondell Basell, which will help reliance ind to enter in to lucrative USA markets.

Full utilization of gas from Krishna godavri basin is also positive for Rel ind.

As per sources reliance to un-lock the value of reliance retail by listing on the exchange!

As per sources government is all set to give free fuel pricing policy, which will help reliance to sell its product across the India

ONGC

Free fuel pricing policy will help the co and divestment of govt stake.

Free fuel pricing policy will help the oil marketing companies like Indian oil, hpcl, bpcl.

Commissioning of hpcl –mittal (bhatinda refinery) will also help this company.

Indian Oil Corporation Ltd

IOC is looking to invest up to Rs 1,500 crores in its maiden nuclear venture in partnership with Nuclear Power Corporation of India Ltd (NPCIL).

As per sources, A core group comprising officials of both NPCIL and IOC will be set up to make a detailed study and assess the investment option for participation either in existing or upcoming projects, including details about the site. The companies will either form a joint venture company or float a special purpose vehicle.

Now looking at the above positive news flow we like oil and gas theme for 2010/2011.

TECHNICAL STOCK PICKS:

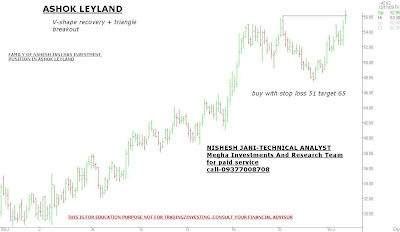

Ashok Leyland

Keep a stop loss of 51, and buy for target of 65.

The stock has created v-shape recovery with good volume!

Punj llyod

Keep a stop of 203 for target 250.

The stock has broken triangle with good volume

Satyam

Keep a stop loss 100 and your target is 136/143.

This stock has created complex inverted head and shoulder pattern.

Reliance comm.

Keep Stop loss at 168 levels and eye for targets of 222/241.

Stock has complete the wave 1 and start wave 2

Reliance ind

Buy if stock close 3 day or weekly close above 1155

After this it will confirm inverted head and shoulder pattern and target is 1320

Ongc

Buy this stock with stop loss 1150 target 1305.

The stock has made triangle on daily chart.

Stop loss should be followed on closing basis!

KEY NEWS TO WATCH OUT FOR NEXT WEEK:

16 major index companies will announce results in this week.

On 18th j.p.associates,gail,sesa goa.

On 19th tata power.

On 20th wipro,hdfc.

On 21st bhel,icici,larson and tubro,idea.

On 22nd reliance ind,grasim,bharti,itc,ongc.

On 23rd maruti Suzuki.