FUNDAMENTAL STOCK VIEW:

HINDALCO INDUSTRIES LTD.

CMP 168.

This counter seems to be overvalued and we recommend to book profit and avoid for any fresh investment.

Rational:

Hindalco Industries Limited, the metals flagship company of the Aditya Birla Group, is an industry leader in aluminum and copper.

Hindalco is the world's largest aluminum rolling company and one of the biggest producers of primary aluminum in Asia. Its Copper smelter is the world's largest custom smelter at a single location.

Company’s copper business is essentially a play on the refining margins as the company does not have its own copper mines that cater to 100% of its concentrate requirement.

Since the beginning of 2QFY09, aluminum and copper prices have shown a continuous declining trend. Aluminum prices have fallen by more than 50% to around US$ 1,300 per tonne whereas copper prices are down by more than 60% to around US$ 3,690 per tonne during the last eight months. The LME prices of both the metals aluminum and copper are trading at their multi year lows. Aluminum prices are trading at almost their six year lows, while copper prices are ruling at their four year lows.

Many people will argue that Indian and Chinese economy is growing and demand will create price in future but this is about the growth oriented investor and not for conservative investors who follow value buying across the market.

Many people and analyst follow the simple rule of P/E multiple and take decision that some stock are trading cheap or overbought but we at MEGHA INVESTMENTS AND RESEARCH doesn’t follow the one thumb rule while valuing a company or industry.

Many people and analyst follow the simple rule of P/E multiple and take decision that some stock are trading cheap or overbought but we at MEGHA INVESTMENTS AND RESEARCH doesn’t follow the one thumb rule while valuing a company or industry.In 2008 when all was well in global, stock was trading above 200 levels and after the sub prime stock crashed to 30 levels at the same time Indian and Chinese economy was growing and still we both are growing so why the stock was crashed?

Reason is simple stock was trading at high based on high growth story and everyone forget the valuation parameter so we know the growth but the valuation should not be overpriced while investing.

Always remember when the party is going to over all musicians’ play their organs vary fast, one should always stop dancing before music stop.

It is possible that after we exit the stock stock may move higher but one should find out the next big opportunity to invest their money without regrets.

Aluminum and copper, being cyclical sectors, cannot be valued on P/E multiple, given the volatility in earnings. During times of cyclical downturns, non ferrous metal companies tend to get severely affected, as the business is capital intensive in nature and has higher fixed cost and vice versa. So we believe a sound and consistent parameter to value the sector would be on the basis of the Price-to-Book Value.

Theoretically B/V is what the shareholder would receive if the company would ever go into liquidation for a conservative investor

At current market price it is trading at 1.34 times of the book value.

We believe that at this valuation HINDALCO IND is trading over priced and one should book profit.

MUTUAL FUND VIEW:

Principal Dividend Yield Fund

Recommendation: Avoid.

Rational:

This fund fails to deliver impressive returns.

WEEKLY MARKET OUTLOOK:

SUPPORT AT-5060-5000-4985-4900

RESISTANCE AT-5120-5150-5200

Last week argued that Sensex need to fill the gap of 17025 very fast and it happen.

From the budget day both index are trading positively with buying from intuitions.

In the last two trading session nifty is trading between 5050 to 5120 and consolidating at higher levels.

Hourly chart are over bought with rising wedge formation which often creates sudden panic in markets.

On the time series we have complete 4 week from the low of 15650, so we may see minor correction in coming days.

Nifty fu has resistance at 5120/5150 levels one can sell with same stop loss and we expect it can fall to 4950 or even to 4900 levels.

CONTRARIN VIEW ON MARKET:

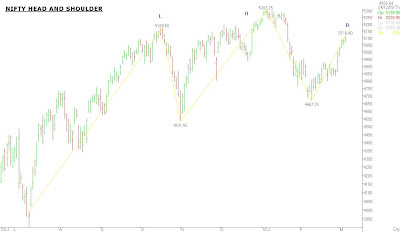

Look at the chart attached of nifty we have shown “head and shoulder “pattern

Left shoulder and Head is already formed!

Now we need to cross 5300 and 17800 in nifty and sensex to make fail this formation.

Remember crossing above 5300 and 17800 will start wave 3rd as per Elliott wave

If we unable to cross this levels then it may create problem

I will update more in my coming reports so wait till the next up dates.

GLOBAL MARKET ANALYSIS:

S & P 500 USA.

Looks the chart attach 3 consecutive close above 1128 will take to 1160/1175 as per shown “inverted head and shoulders patter”

TECHNICAL STOCK PICKS:

Buy on declines and with stop loss as given for short term delivery based.

Guj hotels.

This co is promoted by ITC group from the last ¾ days some accumulation is going on.

Buy with stop loss of 45 targets are 66/80

Tips ind.

Our street walkers says in the next few days we may see some good news

Buy with stop loss of 55 targets 85/87

First Leasing.

After some good news for non banking finance company from budget for private banks this counter is being accumulated by big corporate house.

Buy with stop loss of 45 targets 75/80

Maxwell.

Street walkers say some buying interest from local punters and they expect good news in coming days.

Buy with stop loss 16 targets 32/40

Container corporation.

Chart indicates some up side.

Buy with stop loss 1150 target 1300

Primal healthcare.

Sell future with stop loss of 427 targets 401/390

Note:

Avoid long position in tata motors,sesa goa,jet air,guj nre coke,moser bare we expect profit booking.

Disclosure: we have vested interest in this report, please read disclaimers and disclosures.

0 comments:

Post a Comment